Shipment insurance vs. Carrier liability: What's the difference?

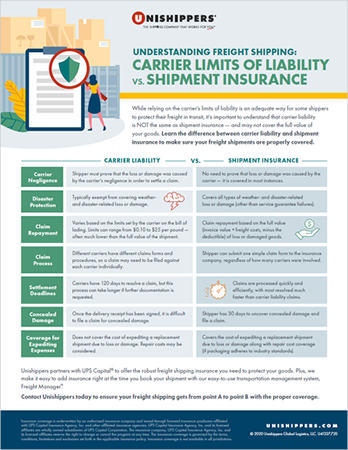

While relying on the carrier's limits of liability is an adequate way for some shippers to protect their freight in transit, it's important to understand that carrier liability is NOT the same as shipment insurance — and may not cover the full value of your goods.

Don't know the difference between insurance and carrier liability?

Download our helpful tip sheet, Understanding Freight Shipping: Carrier Limits of Liability vs. Shipment Insurance, where we break down the subtle differences and help ensure your freight is properly covered.

What's the difference?

If you think your freight shipping is fully covered for loss or damage under the carrier's limits of liability, think again. Under carrier liability, the shipper must prove that the loss or damage was caused by the carrier's negligence in order to settle a claim. The claims process in itself is often cumbersome and time-consuming, with no guarantee of success. In the end, the carrier may not be legally liable and the shipper could be minimally compensated (if at all).

On the other hand, when you invest in freight shipment insurance, you can ship with confidence knowing you will be compensated for the full value of your goods in the event of loss or damage. Plus, claims are processed quickly and efficiently, with most resolved much faster than carrier liability claims.

Choosing the right shipment insurance

There are many types of freight insurance policies, with varying levels of coverage. When choosing the right shipment insurance for your business, it's important to evaluate the policy in full (rather than discover what's missing when it's time to file a claim!).

When choosing an insurance policy for your freight, consider the following:

- What is the additional cost?

- What events are covered by the policy?

- What level of coverage does my business need?

Robust shipment insurance through UPS Capital®

Unishippers partners with UPS Capital® to offer the robust freight shipping insurance you need to protect your goods in transit. Plus, we make it easy to add insurance right at the time you book your shipment with our easy-to-use transportation management system, Freight Manager™.

Ready to get the protection you deserve?

Download our tip sheet to learn if you can rely on carrier limits of liability for your freight, or if you should invest in more robust shipment insurance. Ready to take the next step? Contact Unishippers today to ensure your freight shipping gets from point A to point B with the proper coverage.

Insurance coverage is underwritten by an authorized insurance company and issued through licensed insurance producers affiliated with UPS Capital Insurance Agency, Inc. and other affiliated insurance agencies. UPS Capital Insurance Agency, Inc. and its licensed affiliates are wholly owned subsidiaries of UPS Capital Corporation. The insurance company, UPS Capital Insurance Agency, Inc. and its licensed affiliates reserve the right to change or cancel the program at any time. The insurance coverage is governed by the terms, conditions, limitations and exclusions set forth in the applicable insurance policy. Insurance coverage is not available in all jurisdictions.